— Focus on what’s essential for your business

Get the most out of your solution for financial planning!

Financial planning is essential for your business to maintain sustainability and achieve growth. However, you need a reliable and robust solution to help you manage your resources and empower you to financially plan for both today and the future. Does your financial planning solution allow you to focus on what is essential for your business? Does it help you to strategically reach your company’s potential for growth? Does it reduce potential flaws, delays, and errors in your planning?

In this article, we will reveal seven successful tips to maximize your financial planning solution so you can stick to what is important. Make better decisions faster with these measures:

1. Use a driver-based model for sales budgeting and forecasting

2. Plan your workforce (Personnel module)

3.Plan your investments(CapEx module)

4. Plan your loans (Loan module)

5. Plan and streamline your processes and tasks

6. Automate/schedule jobs (Operation Manager)

7. Compare different scenarios

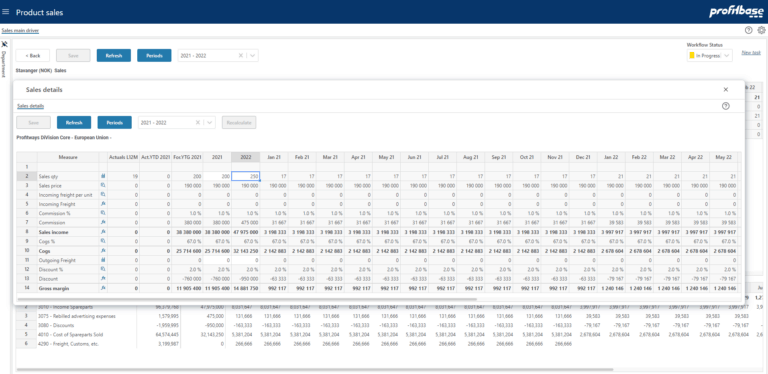

1. Use a driver–based model for sales budgeting and forecasting

A driver-based sales forecast model is the most effective way for businesses to view updated projects on economic changes, market uncertainty, and new opportunities. At Profitbase, we strongly suggest using driver-based models, rather than budgeting on accounts. For starters, driver-based budgeting connects real resources and activities to the financials in the budgeting process.

The beauty of planning with a driver-based model is that users can plan their budget on what drives their business. Operationalize your budgeting and forecasting based on what is important instead of relying on different accounts.

Driver-based models allow companies to see a projected performance in real-time and models business outcomes and economic scenarios. The key to reducing the pain and risks associated with outdated budgeting methods is to budget what drives your business.

Profitbase Planner for budgeting and forecasting gives companies the streamlined process they need to manage their planning and budgeting. This approach identifies an organization’s key business drivers, creating a series of business models that reflect how different variables affect organizational success.

The goal is to focus on business plans upon the criteria most capable of driving success.

Set up different markets and different products and have assumptions of how much you want to sell. Developed to give the best possible numerical accuracy, Profitbase Planner’s Sales Forecast module is a great start. It is a user-friendly tool with high-quality visuals, giving you the option to choose periods on forecasting, especially for a longer horizon on analysis.

A key point with using a driver-based model is that you alter the operations, and the financials will follow. It saves time and enables operational resources to take ownership.

Example 1

In the energy industry, where it is important to forecast years ahead, the planner enables users to take into account large infrastructures, dams, powerplants, and other resources needed for planning. The Profitbase Planner software helps users to adapt their perspective to what the future brings.

If you are challenged with budgeting different legal entities – let’s say 15 different departments, with one separate budget for each department – the structure becomes very complex. The planning process would need several users from the different departments to provide reliable inputs and various forms. How much to expect becomes increasingly detailed, taking the focus away from what is essential to push the business forward.

As mentioned earlier, companies must focus on being driver-based – instead of budgeting on each account, your budget on personnel, and the assets you have.

Example 2

Another example of applying a driver-based model for planning is if you run a hotel. You can calculate the hotel’s income based on the number of rooms; you do not have to sit on every single account. You can budget your income via customizable drivers.

For an end-user who works in operations where the logical productivity measures are volume sold, Profitbase Planner’s Sales Forecast module shows the quantity the user will sell and how much they will produce.

Overall, driver-based budgeting and forecasting both allow businesses to operate in a highly streamlined and efficient manner.

2. Plan your workforce (Personnel module)

Plan your full-time equivalent (FTE) to keep up-to-date on the number of employees in your company or within a project – this refers to staff on a full-time schedule. It is a handy way of measuring because it helps businesses to estimate labor costs.

With Profitbase Planner’s Headcount planning personnel module, users can:

- Import information from your current system

- Check on the number of employees in your organization

- Add and remove employees and/or employee categories

- Review, calculate and modify staff salaries (increase or decrease)

- Get a drill down on every account

- Get an updated budget based on input on personnel

3. Plan your investments (CapEx module)

Planning is crucial when considering long-term investments. When managing capital expenditure (CapEx) connected to machinery, buildings etc. you want to be able to easily compare forecasted income with the costs you expect over the life span of the investment. Profitbase Planner will automatically calculate depreciation and cash and balance effects.

By incorporating investment requirements in the budgeting and forecasting process, a company will be able to make effective, credible, and reliable plans by taking into account the need for investments to meet future goals and objectives.

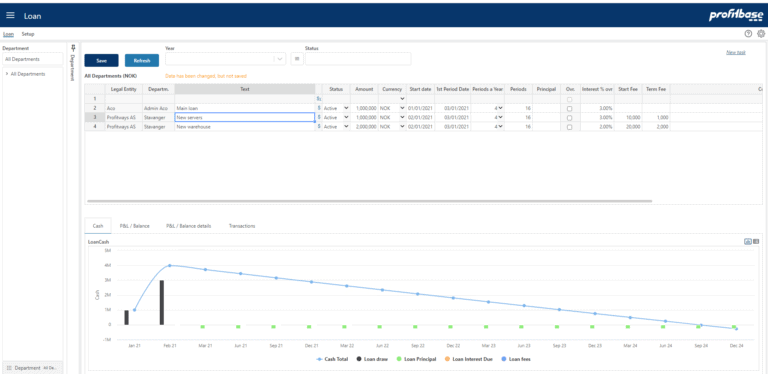

4. Plan your loans (Loan module)

You can plan your loans better by considering that future investments may require loan financing. Part of managing your business is about looking at ways to best reduce and manage your loans and debts. Profitbase Planner caters to a variety of loan types – both external and internal – and takes care of the receipt of the loan (cash), as well as the payment of interest and principals. This financial planning tool ensures that companies keep their profit and loss (P&L) and balance statements as up-to-date as possible.

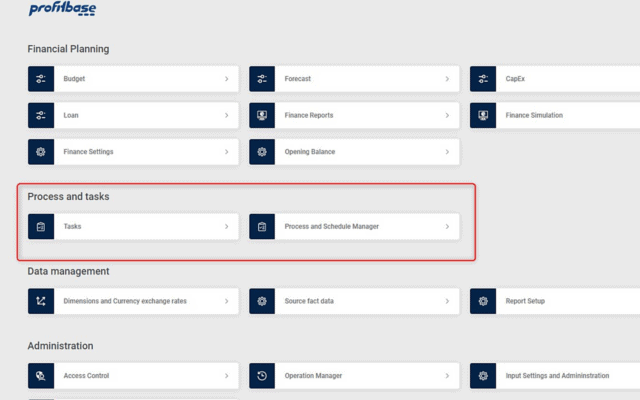

5. Plan and streamline your processes and tasks

A streamlined process and task management system can increase operational efficiency, create a speedier workflow, and reduce errors. Profitbase Planner gives businesses an easy way to improve their processes, equipping them with an effective self-service system to strengthen the work process and manage both process tasks and ad-hoc tasks.

With the Task module, creating tasks has never been simpler. Tasks can be assigned to roles and users with due dates, priority, classification/type, add checklist items, and information including external links. Both the task giver and receiver can receive notifications when a task is assigned, overdue, or closed – this gives greater clarity and visibility on updates and improves the communication flow for each task.

Profitbase Planner’s Process and Schedule Manager is the perfect tool for recurring processes such as monthly forecasting, giving clarity on everyone’s tasks. The tool provides a smoother process for budgeting, forecasting, and monthly closing projects.

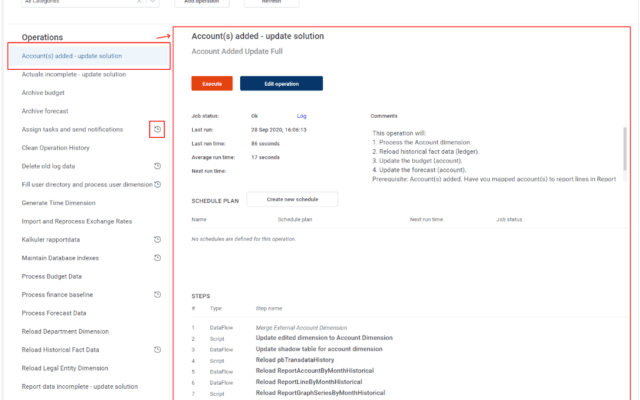

6. Automate/schedule jobs

There are many recurring tasks in financial management. One of the best methods to improve task efficiency is an automated job scheduler. Profitbase Planner’s Operation Manager is a handy tool for businesses, giving them smooth workload automation and timely job scheduling to reduce repetition and mundane routine work, and the ability to execute jobs outside of office hours. Therefore, this solution is automated, minimizing human error, where no steps are missed, and every step is streamlined for visibility, clarity, and efficiency.

7. Compare different scenarios

Finally, businesses can maximize their financial planning solution by comparing different scenarios. Companies that show operational resilience and high performance have budgets and forecasts that align with their goals and objectives. Accurate scenario planning empowers them to confidently analyze different potential business outcomes, including sales, staff headcount, and cashflow. When businesses are reliant on foreign goods as input to their products – for example – they can create scenarios and compare different forecasts, considering how changing exchange rates would affect their product.

Be financially strategic and focused

Overall, companies using fast and accurate planning solutions for multiple scenarios become better equipped to predict their future performance and minimize uncertainty – they become more strategic and focused on the future.

Want more information?

>> Contact us

>> Profitbase Planner 4.1 – new features

Keep updated

Subscribe (English or Norwegian) to the Profitbase newsletter to get notified about future updates.