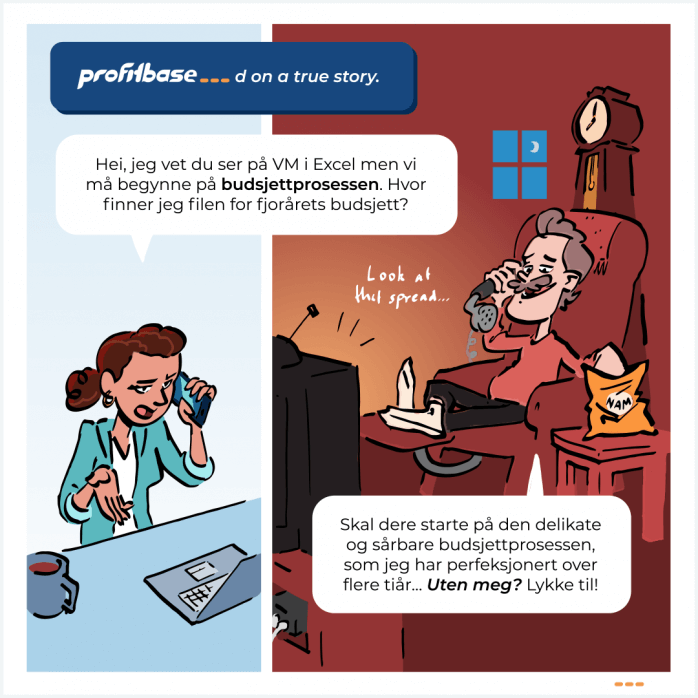

Talk to us about how you can make consolidation more efficient.

Profitbase

Consolidation

Hvorfor Profitbase Consolidation?

Akselerer avslutningsprosessen

Kortere avslutningssyklus

Profitbase Planner gives you the capacity to focus on value creation. Spend less time gathering data and more time analyzing it.

- Import data from your business apps

- Easily build and maintain input models over time

- Know who contributed with what

- Get automated suggestions for budgets and forecasts based on historical data

Kontinuerlig rapportering og kontroll

Unngå overraskelser på slutten av rapporteringssyklusen

Build a common understanding of what matters.

- Ensure data integrity and consistency across your models

- Make the input relatable across the organization

- Manage tasks and see who is lagging behind

- Understand all assumptions and calculations – no more disconnected spreadsheets

- Gain access to user-friendly interfaces, making it easy to get input from all contributors

Prosessoptimalisering

Hold orden på konsolideringsprosessen

Analyze different scenarios, and get a better understanding of the financial impact of conceived situations on liquidity, profit and balance sheet.

- Get automatic generation of balance and liquidity when running scenario simulations

- Return to a previous version at any time to backtrack assumptions

- Experiment with reorganizations, run simulations, and review the outcome in isolated versions

- Test your business strategies and scenarios with various assumptions and business drivers

Prosessoptimalisering

Hold orden på konsolideringsprosessen

Profitbase Planner is built on our own low-code platform that enables customers to extend its features quickly and efficiently.

- Extend Profitbase Planner with apps that are unique to your business process

- Make extensions an integrated part of the Planner solution

- Upgrade to newer versions without breaking your extensions

Customer Success

Fewer hours, more accurate work!

Do you want to know more about Profitbase Consolidation?

See how consolidation can be simplified